What is Product Portfolio Management (PPM)?

Product Portfolio Management is an approach to managing the balance of investments in a company’s product initiatives to increase market share and revenues.

Typically, in project management, the makeup of the product portfolio is determined by the overall investment level (R&D or new product development (NPD) budget), strategic alignment, and risk tolerance. Risk management often comprises multiple variables, such as market and technical risk. The best new product development process includes portfolio management to select new projects.

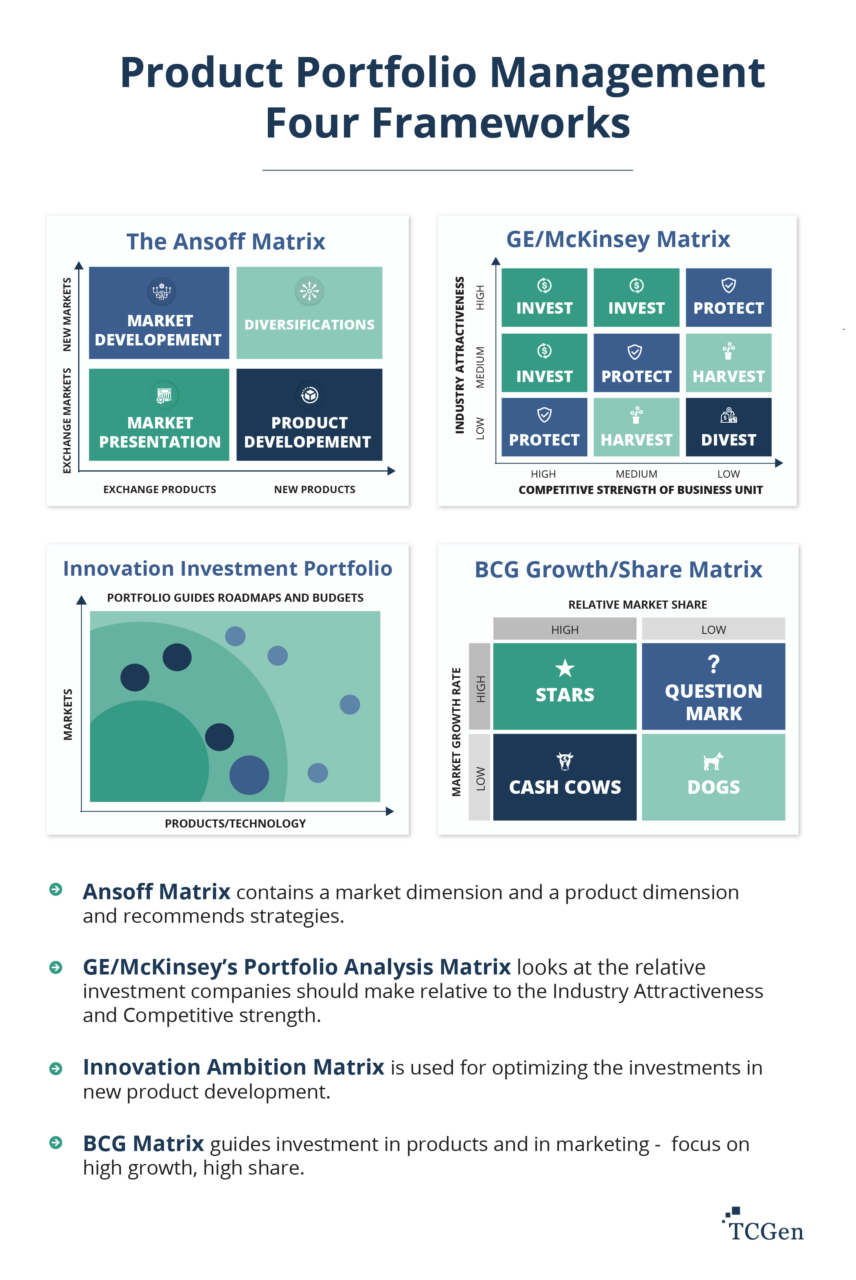

Four commonly used project management frameworks are used for managing a company’s product portfolios in product development and in-market. These matrices help managers decide relative investment levels based on market and product characteristics. Although these frameworks are good, self-contained ways to share the strategy, a product management consulting engagement might go deeper and work with you to select and apply these frameworks.

Product Portfolio Management Frameworks

Product Portfolio Management Guide

"*" indicates required fields

There are several trendy and useful tools for Product Portfolio Management, each with a slightly different take on the product portfolio analysis that a product manager should have in their toolkit. The best-known frameworks are:

- Boston Consulting Group’s Growth Share Matrix

- GE/McKinsey’s Portfolio Analysis Matrix

- Ansoff Matrix

- Nagji & Tuff’s Innovation Ambition Matrix

Innovation Ambition Matrix is used primarily for optimizing investments in new product development. It is forward-looking and has the dimensions of market and product.

BCG Growth-Share Matrix guides investment in new product development and marketing by helping companies find high growth and high share opportunities (Stars) and avoid low growth and low share (Dogs). They recommend investing in Stars and divesting Dogs. The other quadrants are “Question Marks” (Low Share, but High Growth) and “Cows” (Low Growth but high share).

GE/McKinsey’s Portfolio Analysis Matrix looks at the relative investment companies should make relative to Industry Attractiveness and Competitive Strength. This is a similar view to the BCG matrix but includes one market dimension and one firm dimension. It combines internal and external factors to guide investment.

Ansoff Matrix contains a market dimension (existing versus new markets) and a product dimension (existing versus new) and, based on the quadrant, recommends everything from conservative market penetration (Existing products, existing markets) to diversification (New Products and New Markets).

Which tool to use is largely dependent on your situation. If you are a…

- Large company looking at the business unit level use the GE/McKinsey Matrix.

- Tech company, then the Innovation Ambition matrix is for you.

- Mature business in multiple markets, the BCG Matrix would be most helpful to achieve your business goals.

- Typical company looking at framing your business strategy should use the Ansoff Matrix.

Product Portfolios, Product Roadmaps, and Product Development are Tied Together

Regardless of which kind of matrix you choose, it is important to link the portfolio to the overall business strategy (upstream link) and to tie the portfolio strategy to product roadmaps (downstream link). The portfolio serves as a bridge between market strategy and product development.

Product Portfolio Management Examples

These are some common axes that are used to define and shape a product portfolio mix:

- Investment versus market/technical risks (most common)

- Market growth versus market share (second most common)

- Revenue or profit versus strategic alignment

- Competitive position versus market maturity

- Industry attractiveness versus competitive strengths

If you are applying a risk-based approach, a company might allocate its investments in three categories:

- Core Products

A core product introduces a modification of an existing offering to create a new product or new product line. This core product often has the highest market share and delivers the most to the bottom line. Core products are sold to existing customers and leverage existing product technologies. Typically, they have the highest resource allocation in the product portfolio. - Adjacent Products

Adjacent products are conceptually and functionally the same as core products, but they serve a new market to the company. Or they may consist of a substantial modification to a product, expanding the market the company has already entered. These are often variants or derivative products from an existing product line. - Transformational Products

Transformational products innovate in products and markets simultaneously. They may involve a ground-up design or a new-to-the-world product. They often include dramatic improvement in functionality or performance.

McKinsey Study Supports Balanced Product Portfolio

A study by McKinsey and Co., published in the Harvard Business Review, found that “Companies that allocated about 70% of their innovation activity to core initiatives, 20% to adjacent ones, and 10% to transformational ones outperformed their peers, typically realizing a P/E premium of 10% to 20%… Our subsequent conversations with buy-side analysts revealed that this allocation is attractive to capital markets because of what it implies about the balance between short-term, predictable growth and longer-term bets.”

“A comprehensive audit will reveal how much time, effort, and money are allocated to core, adjacent, and transformational initiatives—and how that allocation differs from the ideal ratio for the company in question. With the difference exposed, managers can identify ways to achieve the desired balance….”

Source: Harvard Business Review

Example: A consumer bicycle company

A consumer bike company might continue to improve the usability of its product line for the general market and create a new product portfolio plan through a stream of incremental innovations. For example, the company might add disk brakes or electronic gear shifting.

This is innovation in their core offering, an opportunity to increase market share, and an obvious choice for their product portfolio. However, if the company wishes to expand, it might try to market existing bikes to the professional bike messenger market or create an electric bike. The first project introduces market risk, and the second approach introduces product risk.

A transformational product for the consumer bike company might be a ground-up design of a cargo transport bike for professional bike meal deliverers. This project would involve a clean sheet design while marketing to a new audience. It introduces both market and product risk simultaneously.

An Agile bicycle company could implement agile changes to its portfolio in weeks or months, not years, to take advantage of new opportunities quickly.

Examples of Product Portfolio Management Investment areas

Example: A mature company in an established market might have a product portfolio resource allocation of 70% for core products, 20% for adjacent products, and 10% for transformational product lines. This is a relatively low-risk approach to growing market share and a product life cycle strategy based on profitability versus growth.

“Takeaway: Tailor the ideal investment profile to your company’s type, its maturity, and its appetite for risk.”

Example: A growth company might have 40% invested in the core, 40% in adjacent, and 20% in transformational initiatives. Like mature companies, growth companies might have a “cash cow” (see The Boston Consulting Group matrix) that generates profits to fund emerging categories. Growth companies’ metrics to evaluate their success are tied to incremental growth or year-over-year increases in Annual Recurring Revenues (ARR).

Example: A tech startup might allocate all its budget to transformational products because startups often take enormous market and technical risks simultaneously. The company might have one product. It does not have an established market and is willing to absorb greater risk. Focused on growth, it might allocate 0% for Core products, 0% for adjacent offerings, and 100% for the next blockbuster.

Takeaway:

Why Is a Product Portfolio Management Strategy Important?

Product portfolio management is important because it fuels your strategy. The product development strategy is the roadmap, and product portfolio management is the fuel. Various software vendors: Product Board, Aha!, Product Plan, and many others, help with the automation to prevent you from bogging down in the details.

Product portfolio management answers these questions:

- Which programs deserve the biggest investment?

- How should we allocate our R&D and Marketing budgets?

- What should be our product mix

- Incremental improvements to core products?

- Adjacent markets?

- New-to-the-world products?

- How should we shift to faster-growing markets?

- How can we capture greater market share?

Product portfolios help you manage a market basket of potential NPD activities and help you to make sense of how an individual product, including its market share and product features, fits in the overall strategy and adapts to market trends. They enable you to understand products in relationship to one another and to understand them in terms of risk/return. This is so you don’t invest in a single product in isolation. They help you leverage your product platforms and determine the level of funding for derivatives.

Product portfolios, incorporating market research and product features, play a pivotal role in funding winning ideas by allowing companies to align their risk profile with their product development strategy. By utilizing product portfolios, companies can make different investment decisions based on the relative risk-return of each opportunity. Highly innovative products, which have the potential to create new markets, often involve high risk but also offer the possibility of substantial rewards.

Sustainable high growth means creating a great new product portfolio and successive generations of new offerings. Product portfolio management takes a long view. It stages and selects the best product concepts to maximize the total value of innovation and value proposition while balancing risk and reward. It accomplishes this by optimizing resource allocation.

Besides driving growth, product portfolio management can also reduce time to market by tilting investment towards shorter-term projects that emphasize incremental improvement to existing products.

Product Portfolio Management Allocates R&D and Product Development Budgets

The product portfolio management concept is derived from the basic principles of financial investing, namely that portfolios need to be diversified, appropriate to the risk you want to assume, and managed strategically to achieve defined objectives, often with a focus on how much investment should go into more risky product innovation projects. In other words, a product portfolio strategy that integrates and optimizes a diverse set of projects and strong product lifecycle management ensures diversification.

Product portfolio management is about maximizing your return on investment in new product development. It aligns your current products with your strategy and reflects the risk your company is willing to take. The first step is to choose a management framework that aligns with your company’s maturity and market position.

Product Portfolio Analysis: How Do You Get Started?

Often the first place to get started is to capture what you’re currently doing. This begins with a product portfolio analysis, including a baseline of product development spending levels, typically outlined by the company’s financial strategic planning.

After knowing the overall budget, execute these five steps:

- Understand gaps in product performance that need to be addressed

- Determine the dimensions important to you (margin, share, new markets)

- Verify that your product strategy is up to date and products are aligned with strategy

- Capture the current spending of your various product teams

- Map your “To-Be” Product Portfolio (see below)

Mapping Your New Product Portfolio

The product portfolio management map (download the example below) drives an intentional and deliberate allocation of R&D and Marketing investments that realize a risk/reward mix among these different types of products as determined by overall corporate strategy. The map displays the relative investment in various initiatives by diagramming these investments along market and product risk dimensions.

It allows a company to adjust the product portfolio management strategy according to its innovation strategy and risk tolerance. The map displays the various types of projects according to the risk they introduce to show how investments fit your company’s risk profile. It provides a snapshot of the current portfolio and reveals gaps, such as a low commitment to transformational products.

The map also creates a data connection that tracks the financial flow between the corporate strategy – usually the first step in the yearly planning process – and the budgeting process, which usually concludes it. For most companies, this means that you are managing the funding of the entire portfolio and many different products simultaneously.

Product or market risk is not the only possible dimension. The more important axes to track are relative alignment with strategy and relative financial impact of the new product. Modify the plot to reflect the factors most important to your company’s growth.

Download this spreadsheet-based template to help map your product portfolio.

Product Management vs Product Portfolio Manager

One of the most essential components of Product Portfolio Management is how it provides governance for your product line and describes who the product management decision-makers are. The Product Portfolio Manager is most frequently the leader of the product portfolio and works with a general management team to refine it by prioritizing decisions and then making overall portfolio decisions. While the product manager creates the portfolio, the most senior management in the organization approves and manages it.

A Senior Product Manager often oversees strategic investments and reports to the top Executives. This Senior PM’s role is to realize the future of your products. This vision of the future can have many ramifications, from influencing who you want to hire to a decision to disinvest from some product lines that aren’t growing. With the advice of the Senior Product Manager, an executive team then allocates investments in new products based on corporate strategy.

Product Portfolio Management Software and Project Portfolio Management

Product Portfolio Management Software typically includes methodologies integrating a portfolio view and a project view. Connecting the portfolio to individual project data improves workflow and connects product managers to a more significant product line.

These management tools enable scenario planning, allowing users to examine several possible portfolio management choices, make more efficient decisions for product lines to develop the right products, and facilitate resource management.

Other PPM tools help you track growth potential and risk, enabling managers to make better go/no-go decisions. Still, others integrate product portfolio views with product roadmaps or other tools that will allow collaboration in NPD and provide real-time dashboards to communicate status. In IT, for example, it will enable organizations to look at investments at the project level. Many product management and PPM software providers focus on project portfolio management due to its growing importance in organizations of all sizes and industries. With the increasing complexity of managing multiple projects simultaneously, PPM software provides the tools and capabilities to ensure effective portfolio management, enhance project success rates, and optimize resource utilization. As a result, organizations can achieve better alignment between their project portfolios and strategic objectives, leading to improved operational efficiency and competitive advantage.

Managing the Front End of Development – Aligning around Customer Needs

Product portfolio management aims to realize the best and most innovative products in a way that aligns with the vision and overall strategic plan to achieve your business objectives. Executing a comprehensive product development strategy also means having an ongoing process to manage the front end of development.

Many of the early-stage concepts in your product portfolio are worth little or nothing to your company. Others might be the next iPhone or Amazon, ready to disrupt markets, open new categories, and earn enormous revenues. How can your company manage these vague concepts to leverage the best, weed out the rest, and develop the winners into viable products in a competitive marketplace? How can they do the most risk-free product planning? Typically, this is accomplished by a diversified portfolio of products so that all the risk is not concentrated in one considerable development effort.

Many companies maintain that the front end cannot have specific milestones and deliverables. We disagree. Just as projects within the product development pipeline have gates, reviews, and timelines, you can similarly manage the front end of development.

An orderly front-end management process uses rational decision-making to select suitable projects or product ideas to load into the pipeline. It has milestones and budgets that measure progress because approved budgets unlock new tasks. An orderly front-end process can streamline your whole product creation process.

To bring order to the front end of development, use product discovery techniques and create two decision points that help to:

- Manage orderly starting points for projects that:

- Arise from the planning process, or are

- New ideas congruent with that plan

- Staff projects with appropriate resources

- Ensure that projects address the significant risks early in the process

- Evaluate objectively the commercial potential of new ideas

Product Portfolio Management Framework for Success

Product concepts, those germs of ideas that might become the next blockbuster, are of enormous value. Unfortunately, too many companies do a poor job of managing this portfolio of assets and, as a result, don’t get the market share they deserve. They leave vital product concepts to chance. There is another way:

- Understand your risk profile and balance risk and reward.

- Determine the relative investment you want to make in core, adjacent, and transformative products.

- Map your product portfolio to create a visual image.

- Use the smallest appropriate product portfolio software package — don’t get hung up on the technology.

Product portfolio management does not have to be complicated or demanding. Still, it does need to reinforce the corporate vision and support your company to deliver products that provide a differentiated experience in the marketplace.