Product development projects are not all the same. Some represent slight modifications of an existing, time-tested product, a workhorse for your company. Other projects might represent startling, new-to-the-world ideas that disrupt everything. Most others fall somewhere in between.

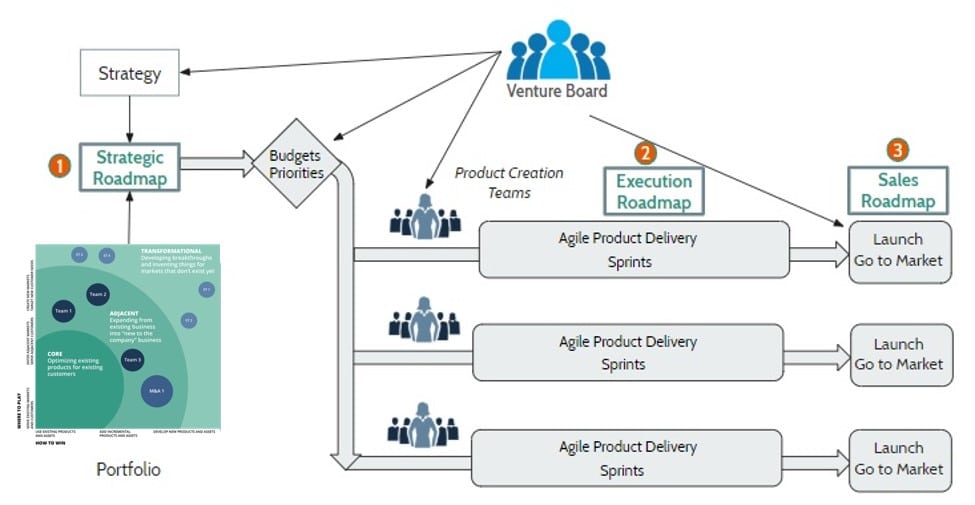

With a limited budget, how can a company best allocate Development investments? What is the right mix of investments? How should this investment mix change, based on the risk tolerance and maturity of the company? First, a company must have a strategic planning process for innovation. Next, creating a Portfolio Investment Map can help.

What is a Product Portfolio Investment Map?

A Product Portfolio Investment Map is a snapshot of product portfolio management that shows the relative emphasis on various classes of new product development projects. Typically, these investments are grouped together according to the amount of risk each project assumes. For example, a company might organize its projects as follows:

- Core products

- Adjacent Products

- Transformational Products

A core product is one that introduces a modification to an existing product. It is sold to existing customers and leverages existing product technologies. Adjacent products are conceptually and functionally the same as existing products, but they serve a market that is new to the company; or they may consist of a substantial modification to a product, expanding the market the company has already entered. A transformational product innovates in both products and markets simultaneously and accordingly has the highest risk – but also the highest potential return.

For example, a consumer bicycle company might continue to improve the usability of its bikes for the general market, through a stream of incremental innovations, such as adding disk brakes or electronic gear shifting. This is core innovation. However, if the company wishes to expand, it might try to market existing bikes to the professional bike messenger market, or it might create a battery powered bike. The first project introduces market risk, the second approach introduces product risk.

A transformational product for the consumer bike company might be a ground-up design of a cargo transport bike for professional bike meal deliverers. This project would involve a clean sheet design, while marketing to a new audience. It introduces both product and market risk simultaneously.

The Product Portfolio Investment Map drives an intentional and deliberate allocation of R&D and Marketing investments that realizes a risk/reward mix as determined by overall corporate strategy. By diagraming these investments along market and product risk dimensions, the map displays the relative investment in the various types of initiatives. It allows a company to adjust the portfolio according to its strategy and risk tolerance. The plot displays the various types of initiatives according to the risk they introduce, in order to show how investments fit with your company’s risk profile.

According to recent research, a stable company in a mature industry might allocate 70% for Core projects, 20% for Adjacent projects and 10% for Transformative products. This is a relatively low-risk approach. A tech startup might allocate less than one half of its Development investment in Core products since the company does not have a large established market and is willing to absorb greater risk. A startup might have 40% invested in the Core, 40% in Adjacent, and 20% in Transformational initiatives. Tailor the ideal investment profile to your company’s type, its maturity, and its appetite for risk.

What are the Benefits?

- Enables a company to intentionally formulate its budget in alignment with overall corporate strategy

- Confirms that the product portfolio reinforces the right risk profile for the company

- Provides a snapshot of the current portfolio and reveals any gaps (for example, a lack of focus on transformational products)

- It’s best practice: most organizations of some size have a model like this

What Business Problems Does It Solve?

Some companies struggle with getting the right mix of products. This tool helps solve this problem, enabling a company to derive the desired allocation mix based on an analysis of the existing portfolio. As the budgeting changes, a company can shape the relative investment based on its preferred risk profile.

Product or market risk are not the only possible dimensions. Modify the plot to reflect the dimensions that are most important to your company’s growth. Whatever dimensions you choose, a portfolio map allows your company to make new investments that align with your overall strategy and vision.

The map also creates connection between the corporate strategy – usually the first step in the yearly planning process – and the budgeting process, which usually concludes it.

What Else You Need To Know?

Conceptually, the Product Portfolio Investment map is a snapshot of your product portfolio. Unlike Platform/Derivative Maps or Product Roadmaps it does not show a sequence of products or events over time. It takes a picture of where your product portfolio is now, while Roadmaps indicate where you want to go.

Often it is very difficult to clearly categorize Development initiatives as either Core, Adjacent or Transformational. There tends to be a certain amount of subjectivity around these categorizations which may introduce error.

Try to create criteria for the various types of initiatives and keep the dimensions consistent. Inconsistent definitions may lead to Development managers gaming the system. For example, if they’re rewarded for performing transformative product development, they may try to fit too many projects into that category. Create definitions of market and product innovation and scrutinize your categorizations of the product portfolio with care.