Innovation Strategic Planning Process: A Long Term Horizon for Product Planning

Before projects become products, they are ideas in the minds of your teams. They begin their life as product concepts, germs of your company’s future growth. How can companies manage the portfolio of product ideas, those as-yet unformed concepts that will eventually enter the pipeline and pass through a gated product development process? In our experience, too many companies do not adequately manage this portfolio of product concepts. They are missing systems for managing the fuzzy front end. What we have discovered is that success begins by having some means of de-mystifying the front end of product development through systems that enable decision-makers to converge on the best opportunities for creating winning products.

This de-fuzzing of the fuzzy front end has two facets: 1) a lightweight process that manages the day-to-day decisions that move and filter product concepts as they progress toward the pipeline and 2) a yearly strategic planning process for product innovation.

A Long-Term Product Plan

This yearly strategic product planning process is a tiny facet of your company’s overall strategic planning activity. The strategic plan incorporates much more than a product plan, of course. A strategic plan considers all of the capital and assets within the company and how they will be deployed. The management of product concepts is a small but crucial part of this yearly strategic process. How does product planning fit into this broader strategic planning activity?

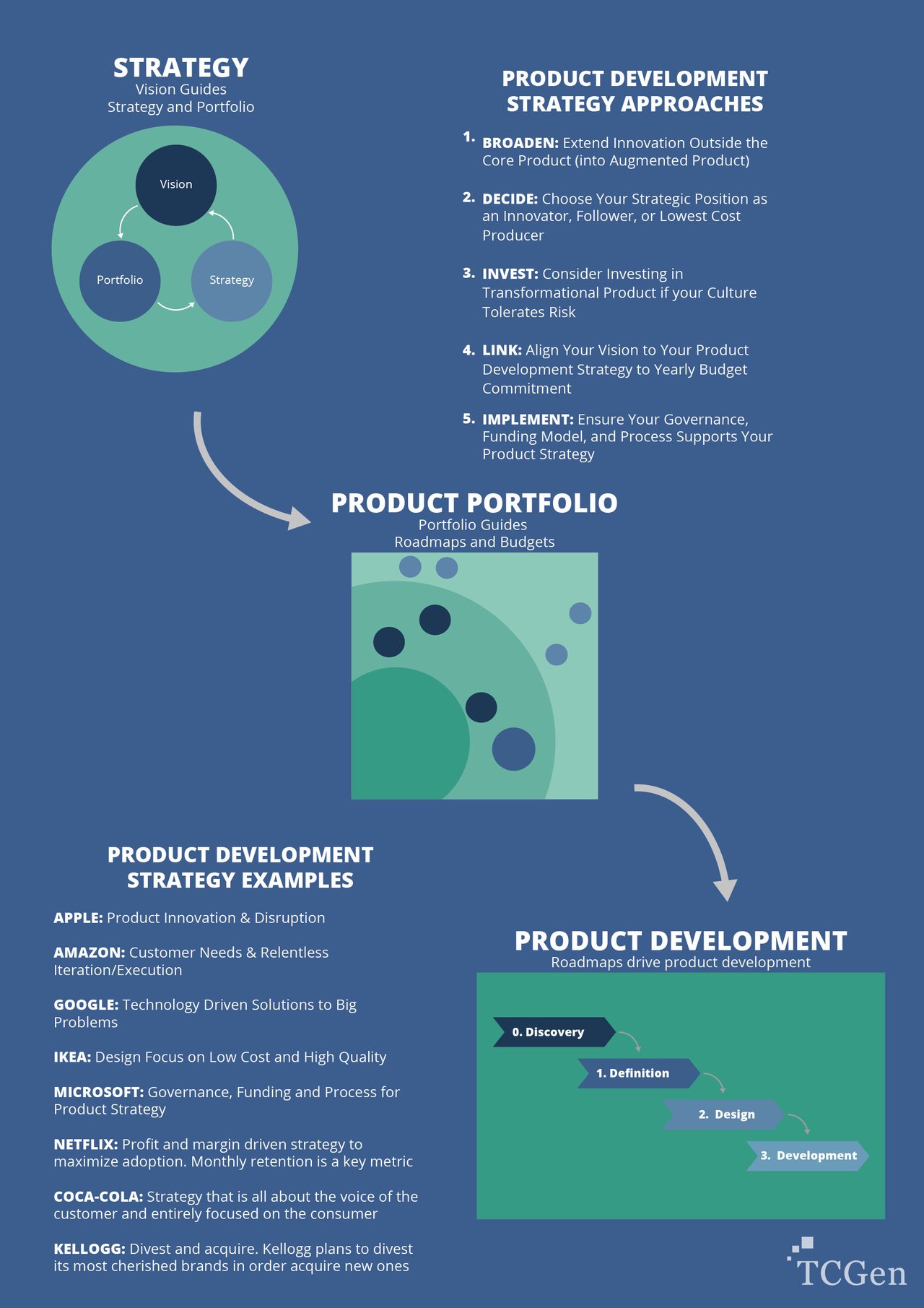

The key is to have a system that connects long-term goals to the day-to-day management of product concepts. The portfolio of product concepts must reflect the company’s overall strategic direction. A strategic product planning process links the company’s vision, usually encompassing a three to five-year time horizon, with the strategic steps required to realize that vision over one to two horizons. It then connects the strategy to product and technology roadmaps – representations that allow decision-makers to see the progression of products and technologies and their changing relationships over time. Then, these roadmaps need to connect to the yearly budgeting process to make sure that products that are coming in the future are prioritized and have the resources they need at this early business concept stage.

In short, a best-in-class strategic product planning system connects vision, strategy, and roadmaps, resulting in budgets that will realize them. It provides the “plan of record” for yearly investments in new product activities.

Steps for Creating a Strategic Product Planning System

Suppose your company does not have a clear way of managing product concepts. In that case, the first step is to take your existing annual budgeting process and determine how planning for product innovation fits into it. The strategic product planning process comes after the overall strategic plan for the year is formulated but before the budgeting process is completed.

Then, map out a yearly process that ties the vision to the overall business strategy, the strategy to roadmaps, and the roadmaps to the budget. Then, create detailed swim lanes showing how the different groups feed each other.

- The beginning and ending points that frame this planning activity are the budgeting process.

- The strategy is not created from thin air each year but is updated yearly. The financial process puts in place the goalposts, and this process connects Finance with product activities.

Next, select a governance body and create criteria for the decision points around product concepts. The decision-making body should include executives who oversee the critical functions in product innovation and strategy (such as Engineering, Marketing, etc.). This governance body also needs to consider how the company’s different groups and core business units will interact to turn these early-stage concepts into fully functioning products.

The governance body should also create clear criteria for evaluating product concepts. These criteria should be analogous to the questions venture capitalists might ask entrepreneurs.

A Basis for Ongoing Management of Product Innovation

Finally, as we have outlined before, it is best practice to connect the yearly strategic product planning system to a related, shorter-term front-end innovation management system that handles the day-to-day decision-making around your portfolio of product concepts. The longer-term, annual strategic planning system aims to set priorities and budgets that help drive the organization toward its goals year after year.

One of the first changes required is in the mental business models with which product developers approach their work. Think of your early-stage product concepts as an asset, a portfolio your team needs to manage. These assets represent as-yet unrealized potential. A strategic product planning process aims to realize the best and most innovative products in a way that aligns with the vision and overall strategy. The outputs from this yearly process become the inputs for a system that manages products to completion and launches them into the marketplace. Winning companies take control of their future by creating a tight link between their strategic direction and product concepts. What is at stake is the future of the company’s product portfolio.