Case Study: Create an Innovation to Commercialization Pipeline

A Strategic Imperative for New Growth

Internally, the company was buzzing with ideas and side projects. Teams were experimenting across engineering, design, and research, but almost none of it translated into real business value. Ideas lived in pockets. Funding was ad hoc. And no one had a path to turn experiments into meaningful revenue.

The company needed a systematic way to identify, fund, incubate, and launch new ventures that could diversify the business and reduce risk. The engagement centered on a simple question:

How do you turn a company rich with ideas into a company rich with new businesses?

The Challenge

The organization had:

- Strong technical talent and a deep open-source culture

- Dozens of uncoordinated prototypes and experiments

- No criteria to compare or prioritize ideas

- No protected funding mechanism

- Weak connective tissue between teams and executives

The motivation for change was clear: they needed new, sustainable sources of revenue—and a repeatable process to find them.

Our Mission

We were asked to help the organization:

- Design a corporate venture model from scratch

- Create the governance, structure, and funding to support innovation

- Build a full pipeline—from idea sourcing to incubation to launch

- Identify the best internal ideas to invest in

- Ensure each funded idea had a clear path back into the business

This became a nine-month engagement partnering with the product, engineering, BD, and support organizations, along with an engaged C-suite sponsor.

Building the Innovation Pipeline

1. Designing the Venture Model

We worked with leadership to build an internal venture system modeled on the discipline of Silicon Valley VC while tailored to the needs of a mission-driven tech organization.

The core elements included:

- A ring-fenced innovation fund to ensure sustained investment

- A dedicated discovery organization, separate from day-to-day operations

- Full-stack incubation teams with protected headcount

- Clear entry and exit criteria for each venture

- A cross-functional venture board responsible for funding decisions and oversight

This gave the company a repeatable engine for identifying and accelerating high-potential ideas.

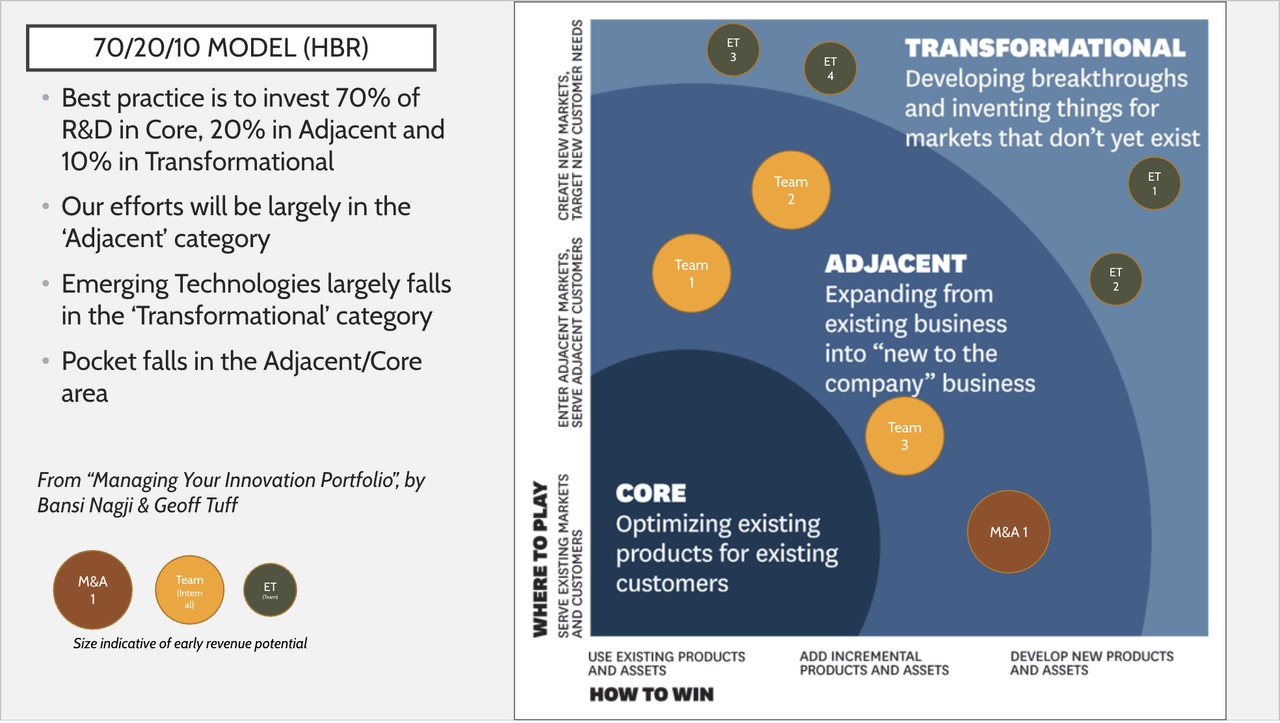

Leverage best practices, like the Harvard Business Review “70/20/10 Model”

Leverage best practices, like the Harvard Business Review “70/20/10 Model”

2. Surfacing and Evaluating Ideas

We performed a comprehensive scan across the organization, including interviews, prototype reviews, and structured sourcing. The result was a portfolio of 30–40 potential ventures, far more than leadership expected.

We then applied a balanced scorecard to evaluate each one:

- Market potential

- Alignment with company capabilities

- Technical feasibility

- Cost and time to meaningful validation

- Strength of the founding team

This established a shared language and consistent criteria for investment decisions.

3. Forming the Venture Board

A cross-functional executive group served as the venture board, providing:

- Governance and oversight

- Funding approval

- Portfolio prioritization

- Rapid escalation paths for organizational blockers

The board approved the initial budget, the process, and the first wave of ventures to enter incubation.

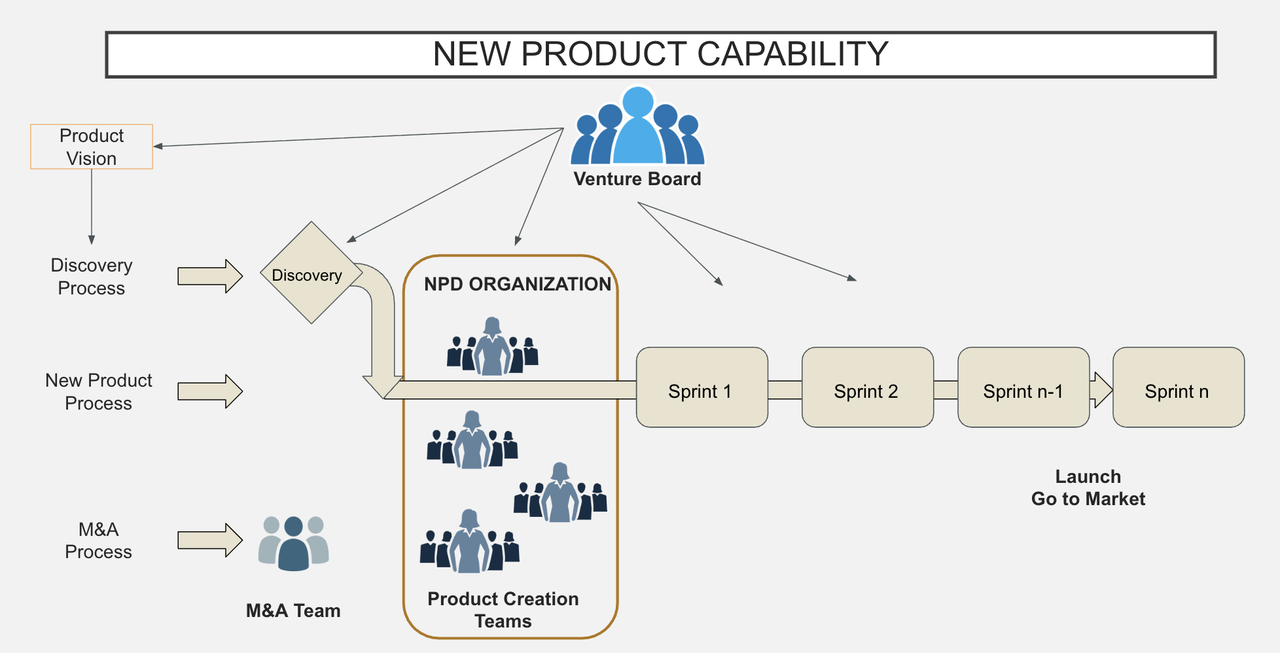

Form a venture board of executives to invest in the most promising ideas and teams across the company

Form a venture board of executives to invest in the most promising ideas and teams across the company

4. Incubating the First Ventures

Three ventures were selected for incubation on staggered timelines. Each one received:

- Dedicated funding

- Full-stack product, design, and engineering support

- Seed-round-style milestones

- A protected structure outside of line management

- Hands-on guidance, including our support on product definition and market research

This was the first time new initiatives had a clear, disciplined structure for advancing from idea to opportunity.

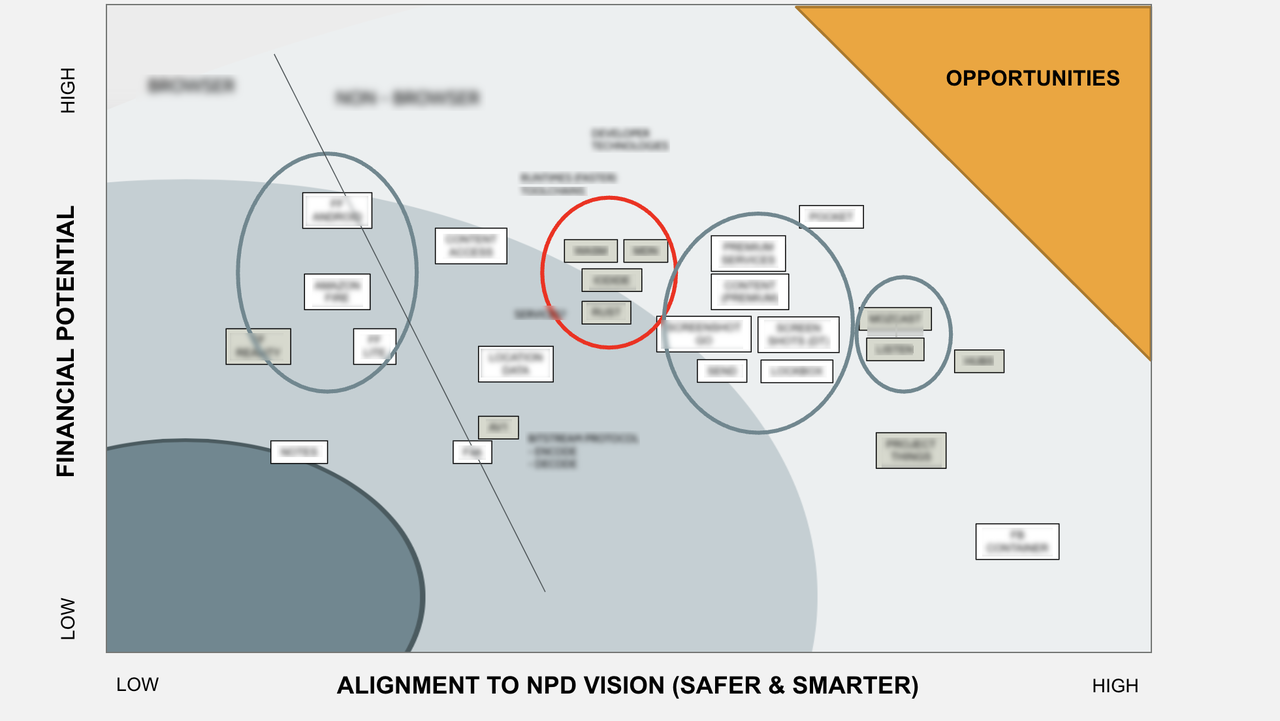

Evaluate opportunities across multiple dimensions to surface great ideas from across the organization

Evaluate opportunities across multiple dimensions to surface great ideas from across the organization

5. Looking Externally

In addition to the internal venture fund, we also defined an investment these for the Business Development team to pursue and M&A approach. This created a clear thesis and guardrails for the team in terms of type of investments, deal size, and qualities that would lead to good acquisitions.

Plot opporunities on a chart to showcase the most promising

Plot opporunities on a chart to showcase the most promising

Results and Impact

The engagement delivered measurable organizational outcomes that established a foundation for sustained innovation:

Catalyzed Broad Engagement: Over 40 teams from across the organization pitched ideas, demonstrating widespread enthusiasm and participation in the innovation process. This level of engagement far exceeded leadership expectations and revealed the depth of entrepreneurial talent within the company.

Established Clear Investment Criteria: Created a transparent, repeatable method and structure for evaluating and funding innovation. The venture board model with defined scorecards gave teams clear guidelines for what constituted a fundable opportunity, eliminating guesswork and political maneuvering.

Raised Organizational Visibility: The highly visible innovation system signaled that leadership was listening and taking employee ideas seriously. This transparency boosted morale and encouraged teams to bring forward their best thinking.

Launched Initial Ventures: Selected and incubated 3 high-potential ventures with dedicated funding, full-stack teams, and protected development timelines. Each venture received seed-round-style support and clear milestones for validation.

Built a Repeatable Engine: Established an innovation-to-commercialization pipeline that the organization could use for years to come. The value wasn’t in creating one or two ventures—it was in building machinery that could systematically identify, fund, and accelerate new business opportunities.

The company now had both the structure and the culture to turn its wealth of ideas into a portfolio of new business opportunities, reducing strategic risk and creating pathways for sustainable growth.